Coronation Road, Balby, Doncaster, South Yorkshire SSTC

Map

Street View

Features

Description

HMO Sales Expert are specialists within the HMO and multi-unit marketplace across the UK. Our experienced team has a combined 100+ years of specific HMO experience including investing, managing, developing, valuing and selling. Every property is exclusively listed, direct to landlord, visited and quality-checked by our team and is sold with NO BUYER FEES or reservation costs. Full access to every financial detail and a pro-active and time-served team to assist you.

7 Coronation Road in Doncaster presents an attractive investment opportunity as a 4-bedroom HMO in a high-demand Article 4 zone. Located at DN4 8BD, this property, with a guide price of £110,000, is positioned advantageously for investors looking to capitalise on the robust rental market in Doncaster.

The property was initially converted into an HMO in 2016, ensuring compliance and high standards of living accommodations. It has maintained excellent occupancy with many long-standing tenants, which attests to its appeal in the local rental market. Currently, the rooms generate a total monthly income of £1,512, translating to an annual income of £18,144. However, with proposed improvements estimated at £15,000 for internal upgrades, the potential rental income is expected to rise to £1,732 monthly or £20,784 annually.

Investors will find the property's location within the Article 4 area particularly beneficial, as it underscores the limited availability of new HMO conversions in Doncaster, thereby increasing demand for existing licensed properties. The property is also uniquely positioned just minutes away from major transport links, including Doncaster Rail Station and several bus stops, facilitating easy commuting and access to local amenities.

The local area of Doncaster is buoyant with development, reflecting in the property values that have been appreciating over the years. This trend is expected to continue, bolstering the investment's potential for capital growth. Additionally, the property is within proximity to various educational institutions, making it a suitable residence for both professionals and students.

Current Income Breakdown (Monthly):

Room 1: £368

Room 2: £368

Room 3: £368

Room 4: £408

Total Monthly Income: £1,512

Current Annual Income: £18,144

Income Breakdown After Improvements (Monthly):

Room 1: £433

Room 2: £433

Room 3: £433

Room 4: £433

Total Monthly Income: £1,732

Annual Income After Improvements: £20,784

Expenditure Breakdown (Monthly):

Gas: £139

Electric: £61

Water: £38.17

Council Tax: £105

Wifi: £19

Cleaner: £20

Management: £150

Total Monthly Expenditure: £532.17

Annual Expenditure: £6,386.04

Net Annual Income (Current):

£11,757.96 (calculated as Current Annual Income - Annual Expenditure)

Net Annual Income (After Improvements):

£14,397.96 (calculated as Annual Income After Improvements - Annual Expenditure)

Commentary:

The room rates are expected to increase after improvements, enhancing the total monthly and annual income. The expenses are based on current figures, and investors will need to consider their own cost of lending and management structure. The property's financial performance indicates an increase in net annual income after improvements, reflecting its potential as a valuable investment. This financial summary does not account for potential vacancy periods or additional management costs not listed, which could impact net income and yield calculations.

Additional Information

| Bedrooms | 4 Bedrooms |

|---|---|

| Bathrooms | 1 Bathroom |

| Receptions | 1 Reception |

| Kitchens | 1 Kitchen |

| Tenure | Freehold |

| Rights and Easements | Ask Agent |

| Risks | Ask Agent |

Gross Yield: 18.00%

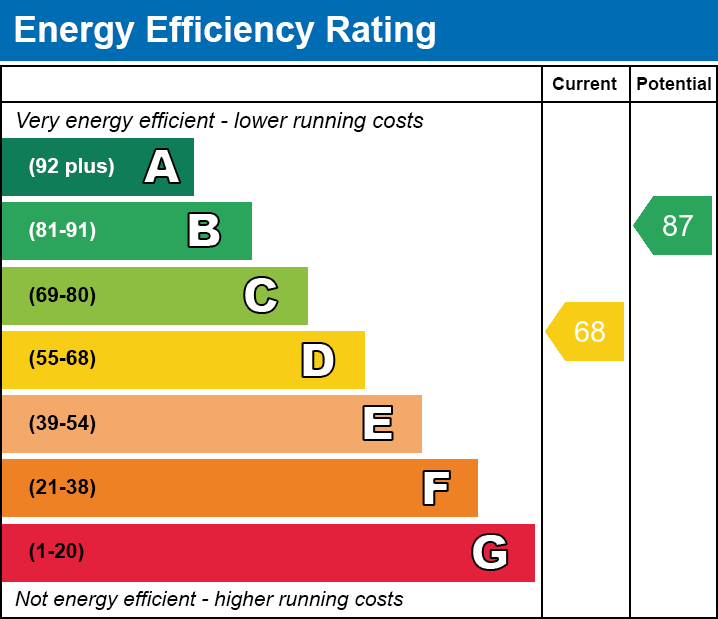

EPC Charts